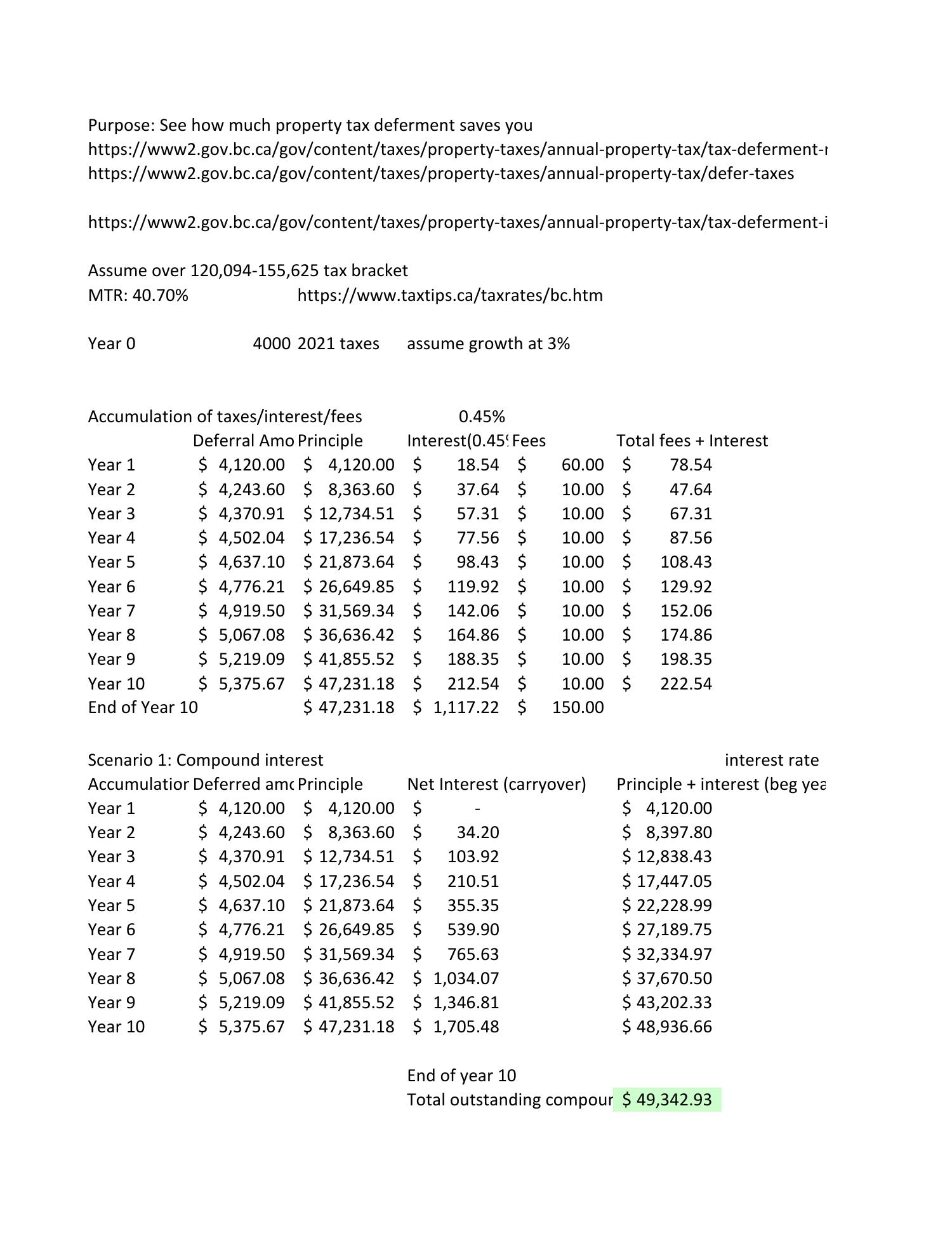

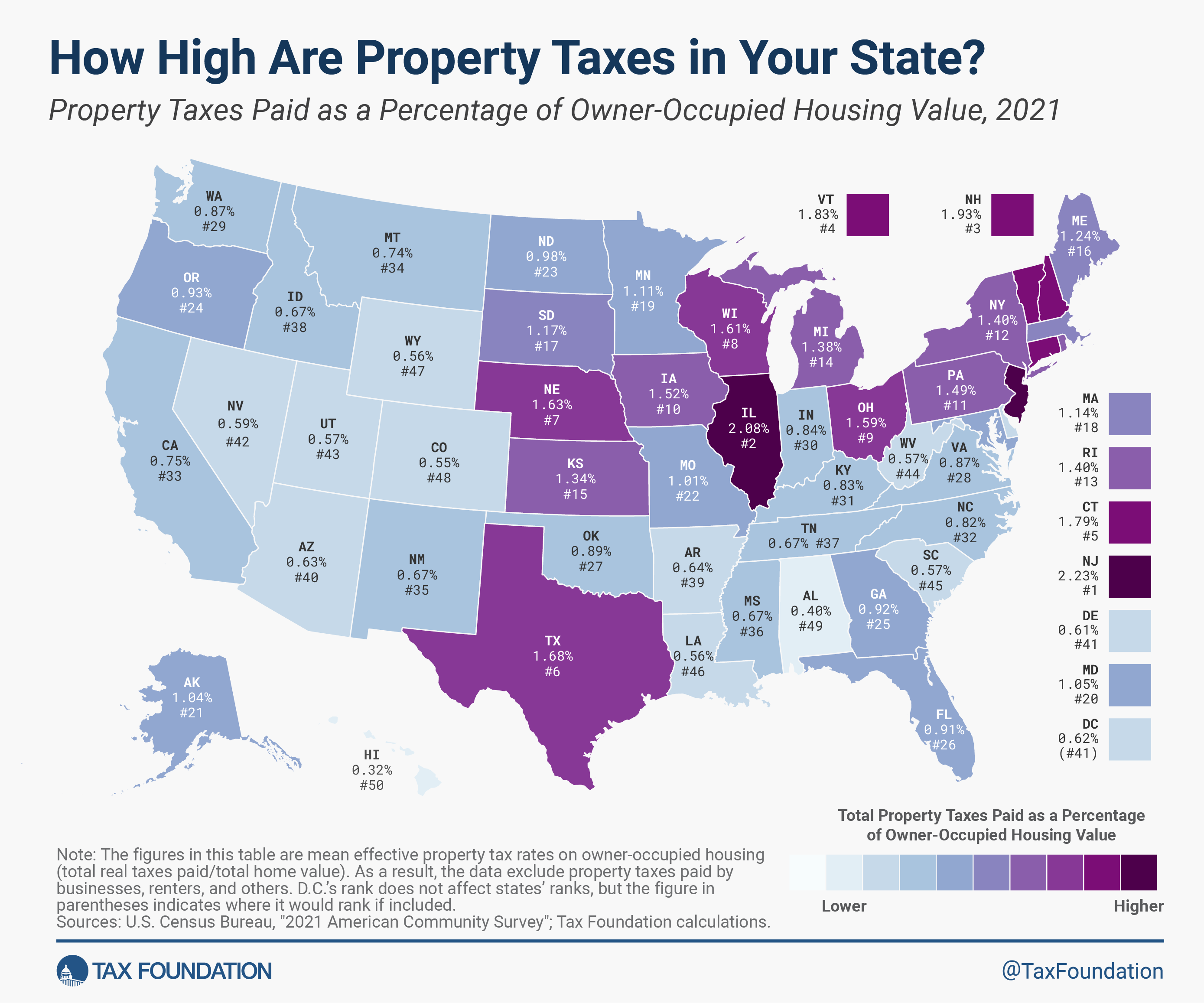

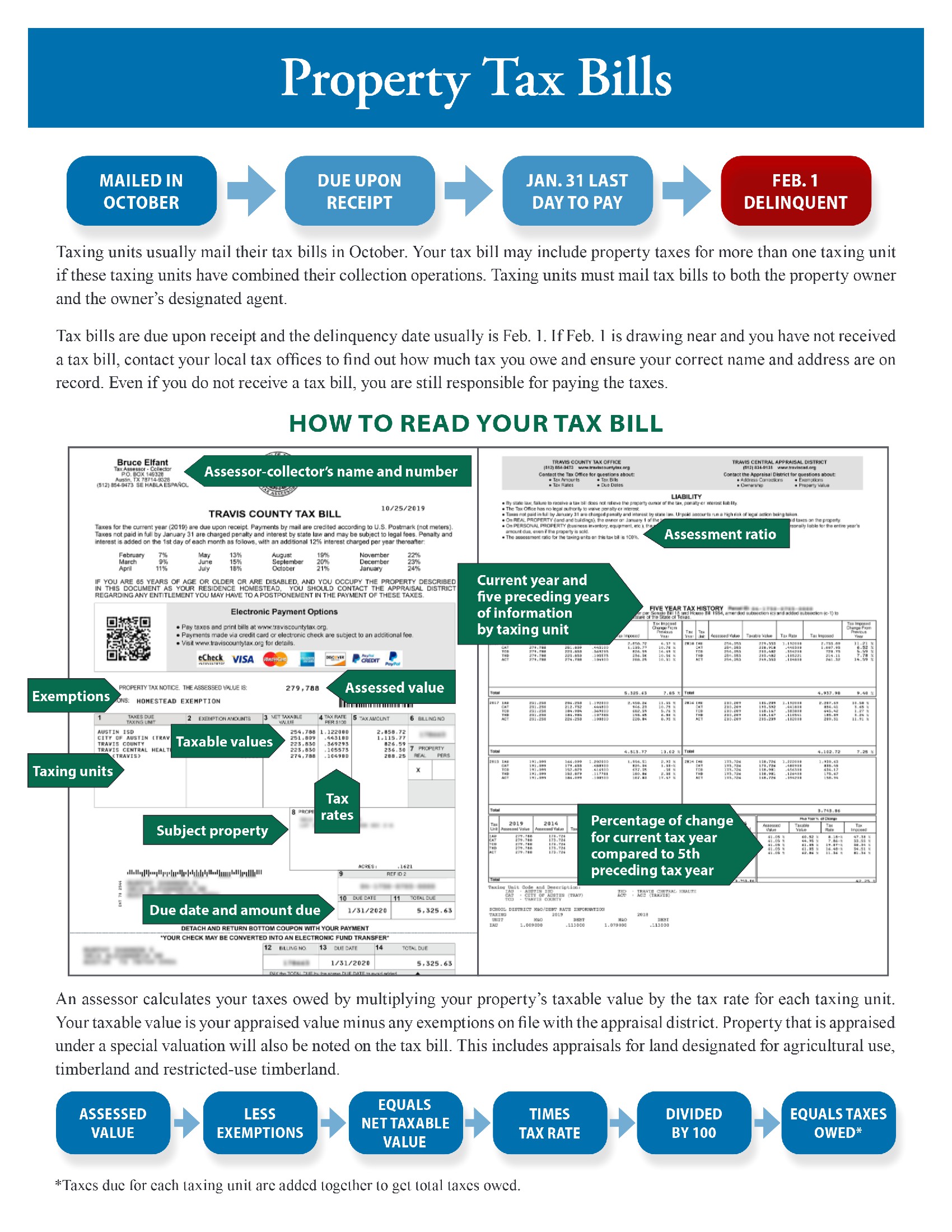

If the tax rate in your community has been established at 1. 20% (1% base rate plus. 20% for prior indebtedness) the property tax would be calculated as. We offer free tax return preparation for qualified individuals and families with an annual household income of $75,000 or less or. Websearch secured, supplemental and prior year delinquent property taxes : Secured tax bills are payable online from 10/2/2024 to 6/30/2025. Most supplemental tax bills are. Webproperty taxes in fremont average $8,050 annually, with a median assessed value of $650,100. The municipal performance dashboard includes financial and operating measures important to the government and its citizens. Webthe real property section is responsible for the appraisal and acquisition of property interests needed for public projects. The section is also responsible for the management. Webproperty construction or change in property ownership. Pay, look up or download your supplemental bill.

Recent Post

- Allied Universal Security Hiring

- Hibid Auctions Idaho

- Does Miley Cyrus Smoke Cigarettes

- Project Zomboid Multiplayer Sleep

- Jobs Hiring 3rd Shift Near Me

- Moores Cabot Funeral Home

- Yourtango 3 Zodiac Signs

- Urban Air Erie Pa

- Celebrity Morgue Pictures

- Ever Loved Obituary

- Tdcj Offender Search Offenders

- Jobs Near Me Construction

- Fareway 3 Day Sale This Week

- Panama City Skipthegames

- Cargris

Trending Keywords

Recent Search

- Indeed Jobs Sioux Falls Sd

- Indeed Lafayette La

- Three Bedroom House For Rent Private Landlord

- Nyc Discount Parking Coupons

- Retail Jobs Hiring Immediately Near Me

- 71st And Lewis Walgreens

- Courtview Greene County Ohio

- Bethel Cemetery Find A Grave

- Home Run Leaders Nl

- Winit Inboxdollars

- Annandale Va Power Outage

- Timber Village Apartments Paducah

- Frito Lay Forklift Operator Salary

- Foggie Holloway Funeral Home Obituary

- Todays Jeopardy

.jpg)